Vietnam Semiconductor Industry Promotion Plan

Phase 1 (2024-2030)

- Vietnam will selectively attract Foreign Direct Investment (FDI), with the goal of establishing at least 100 design companies, 1 small semiconductor chip manufacturing plant, and 10 packaging and testing facilities.

- The objective is to develop specialized semiconductor products to meet the needs of various industries, with annual revenue from the semiconductor industry exceeding $25 billion and a contribution rate to value-added production of 10-15%.

- Additionally, the goal for the electronics industry is to achieve annual revenue exceeding $225 billion, with a contribution rate to value-added production of 10-15%. The plan also aims to ensure that the semiconductor sector will have over 50,000 engineers and university graduates.

Phase 2 (2030-2040)

- The goal is to increase autonomy in specialized semiconductor product design and production by establishing at least 200 design companies, 2 semiconductor chip manufacturing plants, and 15 packaging and testing facilities.

- The target for the semiconductor industry is to achieve annual revenue exceeding $50 billion, with a contribution rate to value-added production of 15-20%.

- The goal for the electronics industry is to achieve annual revenue exceeding $485 billion, with a contribution rate to value-added production of 15-20%.

- The target is to ensure that the semiconductor sector will have over 100,000 engineers and university graduates.

Phase 3 (2040-2050)

- The plan aims to establish at least 300 design companies, 3 semiconductor chip manufacturing plants, and 20 packaging and testing facilities for semiconductor products, with the goal of mastering semiconductor R&D methods.

- The target is to achieve annual revenue exceeding $100 billion for the semiconductor industry, with a contribution rate to value-added production of 20-25%.

- The goal for the electronics industry is to achieve annual revenue exceeding $1.45 trillion, with a contribution rate to value-added production of 20-25%.

Insights:

Vietnam, with its low labor costs and abundant labor force, is gaining attention as an emerging semiconductor production base.

In addition, due to the global supply chain reshuffling after the US-China trade war and the Vietnamese government’s active semiconductor industry development policies, the scale of Vietnam's semiconductor industry is expected to continue growing.

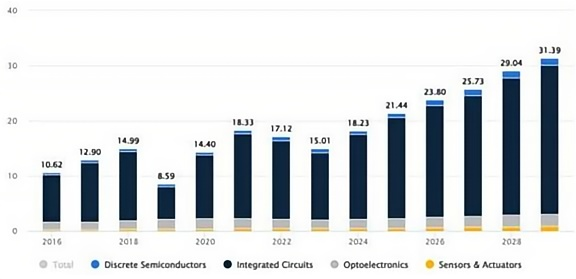

The compound annual growth rate (CAGR) of Vietnam's semiconductor market from 2024 to 2029 is expected to reach 11.48%. As of 2023, South Korea is Vietnam’s largest exporter of memory semiconductor systems, accounting for more than half (50.05%) of semiconductor exports to South Korea. This indicates that one of the main customers for Vietnam’s semiconductor industry is South Korea, and the economic relations and trade dependency between the two countries are high.

Korean companies like Pill, which produce and export semiconductor components in Vietnam, highly praise the potential of Vietnam as a global supply chain solution amidst the US-China trade conflict. They believe that through investment and cooperation, further growth can be achieved. Pill also stated that its exports and imports have been steadily increasing, and mentioned that with the Vietnamese government’s semiconductor industry policies, it is supporting related industries and infrastructure development and planning to actively enter the local market.

However, the ongoing expansion of Vietnam's semiconductor industry faces challenges such as power shortages, a lack of skilled professionals in semiconductor processing, and weak technological foundations. Therefore, analysts believe that the Vietnamese government will need targeted support policies and measures to mitigate these challenges.